Payday Installment Loans Near Me in Hampton, Virginia

Fast Online Approval Money & Cash Advance Lenders (offline stores)

No fax needed :: No hidden fees :: Same day loan approval with bad credit

"HAMPTON, VA, USA"

Founded - 1849 (May) |

|

| The median income for a Household: 51,584 $ |

|

| The median income for a Family: 64,154 $ |

|

| Population - 140,338 |

|

| Area - 136 square miles |

|

| Wikipedia Page: Hampton, VA |

Household Income which has most of the residents of the city: Between 75,000 $ and 100,000$ (13,0%)

1. OnLine (24 Hours): Get up to $1000-5000 payday loan (Low Interest)!

Minimum requirements!

|

Work & Live in USA |  |

Be an 18+ y/o |  |

Have a bank account |  |

Have an email |

>> Apply NOW (2-min Form)! <<

24/7 Online

Our service is working every day, every hour, and every minute just for you! Holiday? Don't worry! Your application will be processed as soon as possible (a loan approval usually takes no more than 5 minutes).

Safe & Secure Form

All of your personal information will be safe (we use the 256-bit SSL secure online form).

Quick Money Deposit

Apply now and the money will be deposited in your bank account today!

300 Direct Lenders

You only need to fill out one application, and hundreds of credit companies get it immediately! Due to the high competition among lending institutions, you can find one of the best direct lender and get payday or personal (installment) loans with low interest rates in Hampton (VA)!

Faxless & Bad Credit OK

You will not be asked to fax any documents, and we do not perform meticulous credit checks. People with bad credit or no credit history at all can still qualify for loans!

>> Apply NOW (2-min Form)! <<

2. OffLine: Loan store (locations) near me

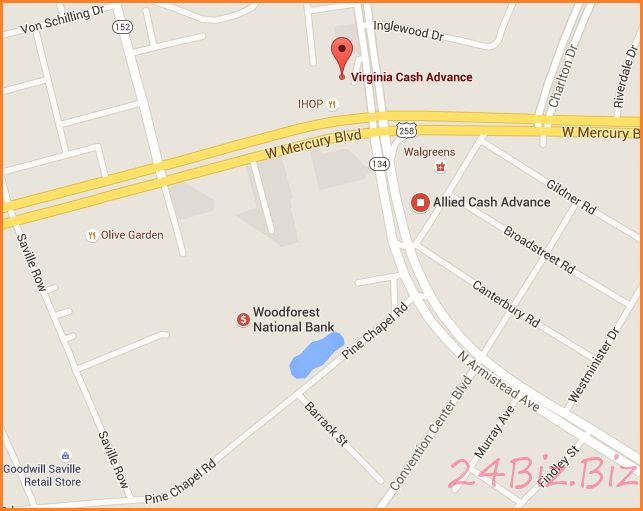

Direct Lender: "Virginia Cash Advance"

Company Address: 2001 N Armistead Ave, Hampton, VA 23666, USA

Company Phone: 1-757-838-8081

List of loan companies in Hampton (money lenders near You) with addresses and telephone numbers:

| № | Company name | Address | Phone number |

|---|---|---|---|

| 1. | First Virginia | 3301 W Mercury Blvd, 23666 | +1 757-506-0006 |

| 2. | Quik Cash | 3018 W Mercury Blvd, 23666 | +1 757-826-7900 |

| 3. | OneMain Financial | 3005 W Mercury Blvd, 23666 | +1 757-826-2296 |

| 4. | Check Into Cash | 4013 W Mercury Blvd, 23666 | +1 757-262-0370 |

| 5. | Cash-2-U Loans | 2811 W Mercury Blvd, 23666 | +1 757-896-2274 |

| 6. | Cash 2U | 2515 W Mercury Blvd, 23666 | +1 757-896-2274 |

| 7. | Fast Auto Loans, Inc. | 1936 East Pembroke Ave, 23663 | +1 757-827-0021 |

| 8. | ACE Cash Express | 3819 Kecoughtan Rd, 23669 | +1 757-728-1366 |

| 9. | SunTrust Bank | 2 E Queens Way, 23669 | +1 757-751-6119 |

| 10. | Express Check Advance | 1106 W Mercury Blvd, 23666 | +1 757-825-0003 |

| 11. | Lendmark Financial Services LLC | 2040 Coliseum Dr #15, 23666 | +1 757-506-7631 |

| 12. | OneMain Financial | 2189 Cunningham Dr, 23666 | +1 757-827-6700 |

| 13. | C&F Finance Co | 1927 C and F Dr, 23666 | +1 757-826-5660 |

| 14. | Allied Cash Advance | 1930 N Armistead Ave Unit A, 23666 | +1 757-825-8700 |

| 15. | Loanmax Title Loans | 902 W Mercury Blvd, 23666 | +1 757-827-3589 |

| 16. | Mr Money | 106 W Mercury Blvd, 23669 | +1 757-727-7833 |

| 17. | Quik Cash | 100 W Mercury Blvd, 23669 | +1 757-726-2888 |

| 18. | ACE Cash Express | 3819 Kecoughtan Rd, 23669 | +1 757-728-1366 |

| 19. | Fast Auto Loans, Inc. | 1936 E Pembroke Ave, 23663 | +1 757-728-3602 |

| 20. | First Virginia | 2001 E Pembroke Ave, 23664 | +1 757-848-1041 |

| =>> Find more loan companies for fast cash near you or online at #1Payday.Loans | |||

You can also visit the loan store in another city (next to you)!

| № | City / State | Postal code | Distance | Company Title | Reviews |

|---|---|---|---|---|---|

| 1. | Newport News / VA | 23605 | 7 miles | "Money Mart" | - |

| 2. | Norfolk / VA | 23504 | 14,2 miles | "First Virginia" | - |

| 3. | Chesapeake / VA | 23324 | 25,9 miles | "Money Mart" | - |

| 4. | Virginia Beach / VA | 23462 | 20 miles | "Easy Money Group" | - |

| 5. | Richmond / VA | 23223 | 75,2 miles | "Check Into Cash" | - |

Useful financial advice ...

"Legal Actions To Take When Employers Pay You Late"

For so many of us employed ones, payday is the day we are always waiting for. However, there are always some unfortunate cases when employers need to delay paying your salary.

If it's a minor delay, and it's explained well by your employer, you might understand and even sympathize. However, if the delay took too long, it may cause a major distress both in your personal finances and the overall condition of the company.

What to do then when your employer delays your paycheck?

Here are some of the things you might do:

1. Check Out Your Location's Payday Laws

As federal laws regulating pay periods may differ between each state, contact your state's department of labor to get a clear information whether your employer is -in legal terms- paying you late.

Paycheck laws can be complicated, so make sure to compile enough information about your specific situation. For example, payday requirements for exempt and non-exempt workers can differ with each other, as do commissioned workers. If you have a working contract, bring it with you as you approach the department of labor.

2. Communicate With Your Employer

If you are associated with a union, this process will be much easier. If not, you might want to approach your employer privately. Effective communications can solve many problems, and this case is no exception. It might be only some unintentional mistake that caused the delay, or minor problems within the company.

However, if the problem is recurring, or there is no clear explanation from your employer, you might want to skip this step.

3. File a Claim

This is the first step of the legal actions you might be willing to take. Contact your department of labor for information regarding its procedure on filling a late-wage claim.

Commonly, you would be required to fill a form with your employer's name, contact information, the total amount of owed salary, and the date when wages were due.

Depending on your state and location, the processing time can vary but usually will take four to six weeks on average.

4. File a Lawsuit

If the claim is taking too long or didn't get results you desired, you might be want to file a suit in small claims or superior court. Remember that legal actions can be lengthy, and may further damage your relationship with your employer, so make sure you consider all other options first.

If necessary, or if the case is large enough and involves a lot of people, you might want to consider hiring a labor attorney.

Bottom Line

Although a late paycheck can be stressful, there are many ways to solve the problem. Make sure you check your location's federal law regarding paycheck regulations before making any legal actions, and most of the time, an effective communication with your employer is always the best solution.

Do You have any positive or negative work experience with this (or other) Financial institution?

Write us a review please! We will submit it on our website. Thank You!