Payday Installment Loans Near Me in Port St. Lucie, Florida

Fast Online Approval Money & Cash Advance Lenders (offline stores)

No fax needed :: No hidden fees :: Same day loan approval with bad credit

"PORT ST. LUCIE, FL, USA"

Founded - 1961 (27 Apr) |

|

| The median income for a Household: 49,236 $ |

|

| The median income for a Family: 53,379 $ |

|

| Population - 175,265 |

|

| Area - 117 square miles |

|

| Wikipedia Page: Port St Lucie, FL |

Household Income which has most of the residents of the city: Between 75,000 $ and 100,000$ (13,5%)

1. OnLine (24 Hours): Get up to $1000-5000 payday loan (Low Interest)!

Minimum requirements!

|

Work & Live in USA |  |

Be an 18+ y/o |  |

Have a bank account |  |

Have an email |

>> Apply NOW (2-min Form)! <<

24/7 Online

Our service is working every day, every hour, and every minute just for you! Holiday? Don't worry! Your application will be processed as soon as possible (a loan approval usually takes no more than 5 minutes).

Safe & Secure Form

All of your personal information will be safe (we use the 256-bit SSL secure online form).

Quick Money Deposit

Apply now and the money will be deposited in your bank account today!

300 Direct Lenders

You only need to fill out one application, and hundreds of credit companies get it immediately! Due to the high competition among lending institutions, you can find one of the best direct lender and get payday or personal (installment) loans with low interest rates in Port St Lucie (FL)!

Faxless & Bad Credit OK

You will not be asked to fax any documents, and we do not perform meticulous credit checks. People with bad credit or no credit history at all can still qualify for loans!

>> Apply NOW (2-min Form)! <<

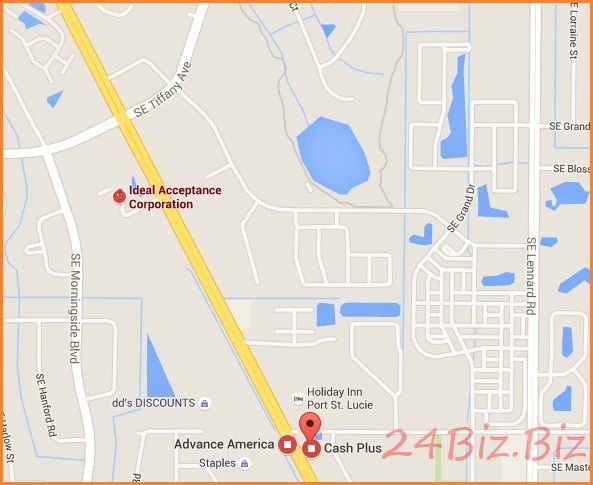

2. OffLine: Loan store (locations) near me

Direct Lender: "Cash Plus"

Company Address: 10200 US-1, Port St Lucie, FL 34952, USA

Company Phone: 1-772-207-3367

Reviews of company (only real):

|

| Name: Michael Baumgardner | Company rating: 4/5 |

|---|---|

| (+) Review: I have to go to that lender as banks reject my application for a personal credit. "Cash Plus" provides a great chance that your loan till payday will be approved in the same day (in the extreme case within the next 48 hours; in my experience). But be prepared for a serious overpayment. |

|

|

| Name: Joshua Kent | Company rating: 1/5 |

|---|---|

| (-) Review: They charge an additional fee for early repayment of the loan! Although the employee did not say anything about it! All the contrary in this company - they love customers who can not return the money back in time and try not to deal with those who pay on time. I think you understand why it is so! |

|

List of loan companies in Port St Lucie (money lenders near You) with addresses and telephone numbers:

| № | Company name | Address | Phone number |

|---|---|---|---|

| 1. | Rapid Auto Title Loans | 3245 SW Port St Lucie Blvd, 34953 | +1 772-200-2114 |

| 2. | Check `n Go | 251 SW Port St Lucie Blvd, 34984 | +1 772-336-8400 |

| 3. | Embassy Loans - Title Loans Made Easy | 1034 SW Bayshore Blvd, 34983 | +1 866-277-5798 |

| 4. | OneMain Financial | 1393 NW Saint Lucie West Blvd, 34986 | +1 772-343-7483 |

| 5. | Check Cashing USA | 325 SE Port St Lucie Blvd, 34952 | +1 772-879-4000 |

| 6. | Mr. Payroll | 2360 SE Rivergate Pkwy, 34952 | +1 772-877-2806 |

| 7. | Advance America | 1149 SE Port St Lucie Blvd, 34952 | +1 772-335-0220 |

| 8. | InstaLoan Loans | 10530 US-1, 34952 | +1 772-335-3720 |

| 9. | Cash Plus | 10200 US-1, 34952 | +1 772-207-3367 |

| 10. | Advance America | 10169 S Federal Hwy, 34952 | +1 772-337-7774 |

| 11. | Abacus Payday Advance | 8721 US-1, 34952 | +1 772-343-0292 |

| 12. | Cash America Pawn | 8429 US-1, 34952 | +1 772-878-1044 |

| 13. | Advance America | 7540, US-1, 34952 | +1 772-621-4433 |

| 14. | Ideal Acceptance Corporation | 7410 US-1 #302, 34952 | +1 772-871-5783 |

| 15. | Bank of America Financial Center | 9110 US-1, 34952 | +1 772-398-8828 |

| =>> Find more loan companies for fast cash near you or online at #1Payday.Loans | |||

You can also visit the loan store in another city (next to you)!

| № | City / State | Postal code | Distance | Company Title | Reviews |

|---|---|---|---|---|---|

| 1. | Palm Bay / FL | 32905 | 58,8 miles | "InstaLoan" | Read |

| 2. | West Palm Beach / FL | 33417 | 45 miles | "Advance America" | Read |

| 3. | Fort Lauderdale / FL | 33316 | 91,3 miles | "Check Cashing USA" | Read |

| 4. | Hollywood / FL | 33024 | 95,6 miles | "Advance America" | Read |

| 5. | Lakeland / FL | 33809 | 131 miles | "InstaLoan" | Read |

Useful financial advice ...

"How to Start a Personal Budgeting Plan!"

The popular belief is that when you earn more, then you can start saving more, and we can't be more wrong. Recent studies show that even those with more than average earning can struggle to make any saving.

It is, after all, not how much we earn, but how we manage our spending. Spending less is one of, if not the most important financial goal for anyone. You can get out of debt, build an emergency fund, and built your retirement fund by doing so. One can say it's one of the necessary habits to achieve financial freedom.

How then can we start spending less? For most of us, it's as simple as start planning your spending by a process called budgeting. Here are a few tips to help you begin:

1. Just Do It

By starting a budgeting plan, you are already halfway there. Set a goal, the goal is not to track every spending you make, but to control your spending so you can spend less in the process.

2. Track Your Spending For A Week

While as mentioned, tracking your spending is not your goal, it will certainly be one of the most important steps to achieve that goal. The goal of this process is to reveal an otherwise unnoticed spending, and providing information about your spending pattern.

3. The 50/20/30 Plan

The popular budgeting plan, popularized by the book "All Your Worth" put 50% of your income to your necessary expenses, 20% to long-term saving, and 30% to your lifestyle choices (or free budget). This might be the easiest way to divide your earnings in a stress-free way.

4. Save First, Spend Later

Change your mentality from spending first and save the rest to save first before you spend. Set a saving goal and do it the first time you got your paycheck.

This strategy is also an exercise for your financial mindset so that you put saving as your first priority instead of spending. Transforming from a spender to a saver is against human nature, and will take a bit of practice.

5. Controlling Your Spending

Most people only overspend in certain areas, for example, having too many fancy dinners, buying too many clothes or gadgets, and too many entertainment spending in a month.

Using the data you got from tracking your spending, pick three of them to bring under control, set a limited budget for each of them. This might be hard in the beginning, so you might set some kind of small reward for yourself if you can limit these 3 budgets successfully after a month.

6. Commitment

Commitment is maybe the hardest part of the journey. To help, you can set a goal that might motivate you. Besides of your long-term saving budget, set a short-term saving plan that might act as a motivation. For example, a short-term saving plan to buy a new gadget, or to go on a holiday, etc.

Sometimes, our minds must be tricked to make a commitment. After all, as mentioned, saving is not natural for most of us.

Do You have any positive or negative work experience with this (or other) Financial institution?

Write us a review please! We will submit it on our website. Thank You!