Payday Loans in Oklahoma (locations near Me):

Cash Advance even with BAD credit (instant decision)

Same Day Services - No faxing, No hidden fees, 24/7 online approval!

"OKLAHOMA, USA"

| Founded - 1907 (16 Nov) |  |

| Capital - Oklahoma City |

|

| Largest city - Oklahoma City |

|

| Population - 3,911,391 |

|

| Area - 69,898 square miles |

|

| Number of cities - 584 |

|

| Abbreviation - "OK" |

|

|

The most important branches of the state's economy are mining, industry and agriculture. The main mineral wealth Oklahoma - natural gas (2nd place in the US by reserves and production of gas) and oil (5th place in the country by reserves and production). In addition, extract iodine, which produce in Oklahoma only. Also mining of limestone, coal, gypsum, granite and other building materials.

What are the advantages of getting a payda loan online?

- Online 24 hours / 7 days

- Fast Approval (about 5 minutes)

- Only Direct lenders (cheap loans)

- Bad credit OK (or no credit history)

- Quick money deposit (same day decision)

- Easy application form (about 2 min)

- NO teletrack / Faxless cash advance

- Up to $1000-$2500 (even with small income)

- Low requirements (18+ y.o., US resident, income)

- We cover ALL cities of the USA, where payday loans are legit

>> Apply NOW (2-min Form)! <<

Do you offer loans with low interest rates?

We work with hundreds of loan companies simultaneously. What does it mean?

Your application will be received by 300 direct lenders, for approval.

Due to the high competitiveness of creditors, we can obtain for you the favorable conditions!

Where can I get fast cash advance with bad credit in Oklahoma (OK)?

If for some reason you do not want to take a loan online, you can visit local off-line credit store. We have selected a reliable companies based on the reviews of ordinary people and our opinion! To find lender's address and telephone, choose Your city below please.

- Oklahoma City

- Tulsa

- Norman

- Broken Arrow

Analysis and research of the market of short-term loans in Oklahoma:

(*based on statistical data of 2015-2016 of company "24Biz")

| How many adult Americans of Oklahoma have used a payday loan? | |

| Average loan per one borrower: |

| Borrower's gender: | |

| Male | 50% |

| Female | 50% |

| What is the age of borrowers? | |

| 18-24 | 12% |

| 25-29 | 17% |

| 30-34 | 15% |

| 35-39 | 12% |

| 40-44 | 10% |

| 45-49 | 15% |

| 50-54 | 8% |

| 55-59 | 5% |

| 60-64 | 4% |

| 65-69 | 2% |

| 70+ | 0% |

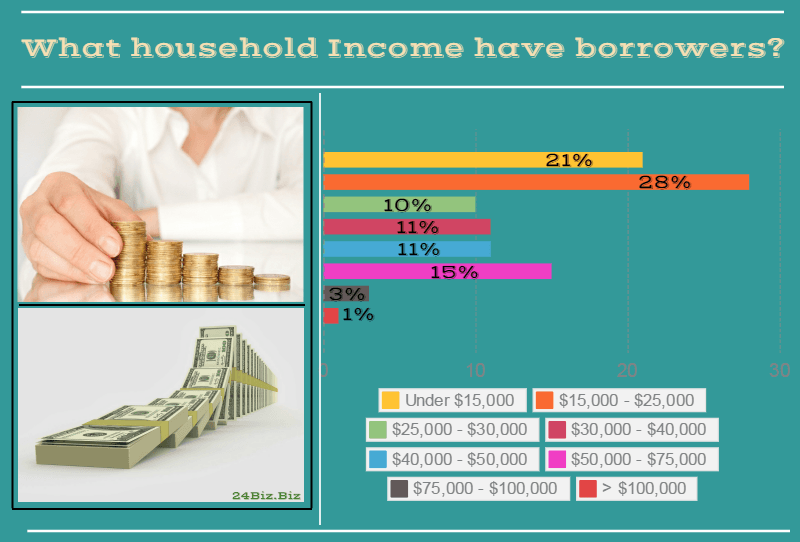

| What household income have borrowers? | |

| Under $15,000 | 21% |

| $15,000 - $25,000 | 28% |

| $25,000 - $30,000 | 10% |

| $30,000 - $40,000 | 11% |

| $40,000 - $50,000 | 11% |

| $50,000 - $75,000 | 15% |

| $75,000 - $100,000 | 3% |

| $100,000 and Higher | 1% |

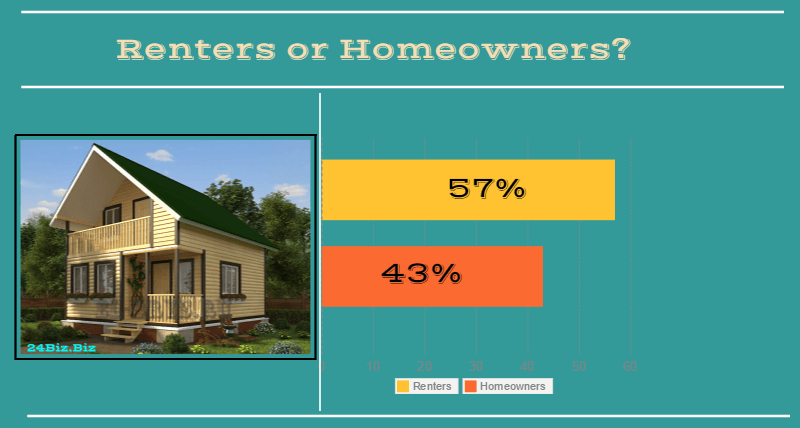

| Renters or Homeowners? | |

| Renters | 57% |

| Homeowners | 43% |

| Which is a employment status of borrowers? | |

| Full-time | 45% |

| Part-time | 15% |

| Unemployed | 13% |

| Homemaker | 14% |

| Disabled | 5% |

| Student | 6% |

| Retired | 2% |

| Education status of borrowers: | |

| Some High School | 20% |

| High School | 37% |

| Some College | 31% |

| College | 12% |

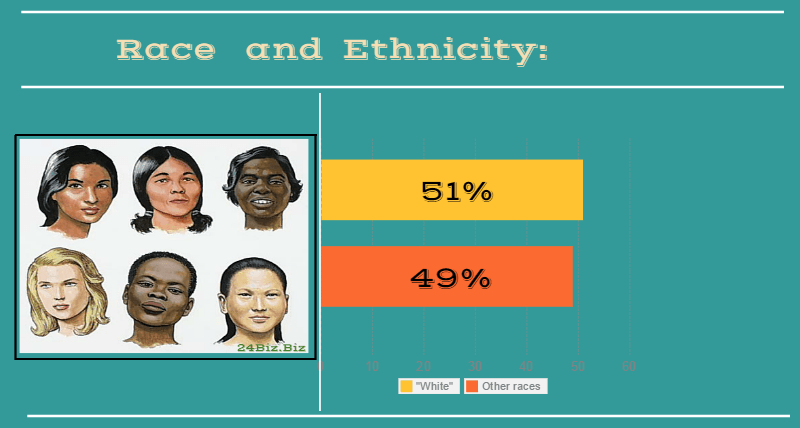

| Race & Ethnicity: | |

| "White" | 51% |

| Other races | 49% |

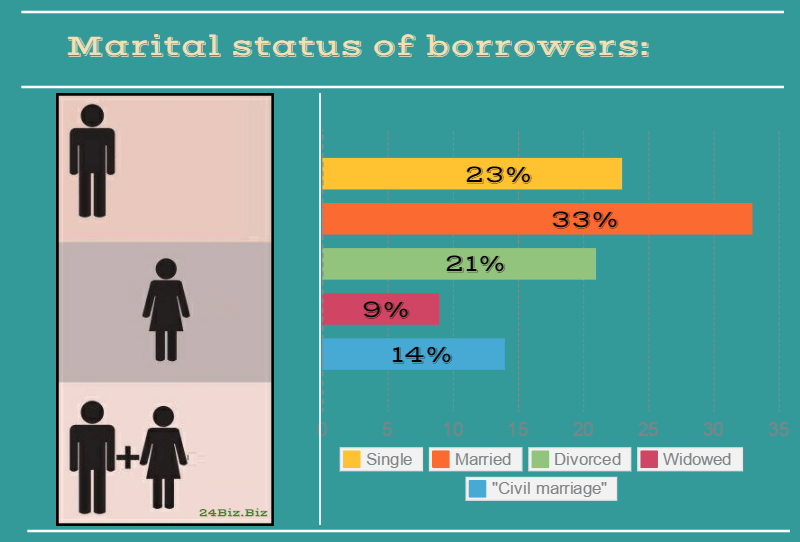

| Marital status of borrowers: | |

| Single | 23% |

| Married | 33% |

| Divorced | 21% |

| Widowed | 9% |

| "Civil marriage" | 14% |