Payday Installment Loans Near Me in Amarillo, Texas

Fast Online Approval Money & Cash Advance Lenders (offline stores)

No fax needed :: No hidden fees :: Same day loan approval with bad credit

"AMARILLO, TX, USA"

Founded - 1877 |

|

| The median income for a Household: 45,659 $ |

|

| The median income for a Family: 56,877 $ |

|

| Population - 198,219 |

|

| Area - 90 square miles |

|

| Wikipedia Page: Amarillo, TX |

Household Income which has most of the residents of the city: Less Than 15,000$ (14,0%)

1. OnLine (24 Hours): Get up to $1000-5000 payday loan (Low Interest)!

Minimum requirements!

|

Work & Live in USA |  |

Be an 18+ y/o |  |

Have a bank account |  |

Have an email |

>> Apply NOW (2-min Form)! <<

24/7 Online

Our service is working every day, every hour, and every minute just for you! Holiday? Don't worry! Your application will be processed as soon as possible (a loan approval usually takes no more than 5 minutes).

Safe & Secure Form

All of your personal information will be safe (we use the 256-bit SSL secure online form).

Quick Money Deposit

Apply now and the money will be deposited in your bank account today!

300 Direct Lenders

You only need to fill out one application, and hundreds of credit companies get it immediately! Due to the high competition among lending institutions, you can find one of the best direct lender and get payday or personal (installment) loans with low interest rates in Amarillo (TX)!

Faxless & Bad Credit OK

You will not be asked to fax any documents, and we do not perform meticulous credit checks. People with bad credit or no credit history at all can still qualify for loans!

>> Apply NOW (2-min Form)! <<

2. OffLine: Loan store (locations) near me

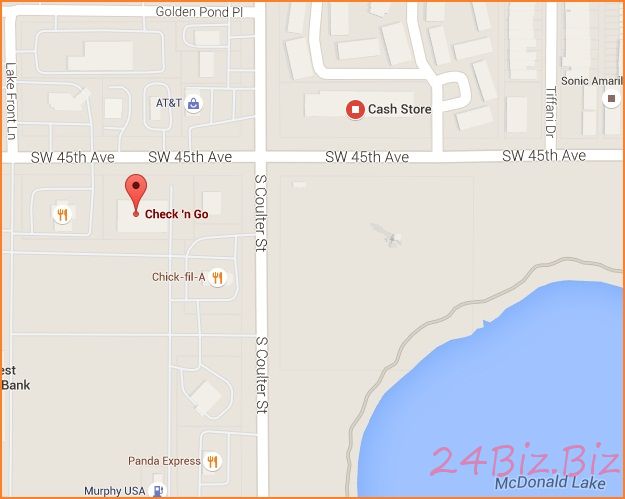

Direct Lender: "Check 'n Go"

Company Address: 7401 SW 45th Ave, Amarillo, TX 79119, USA

Company Phone: 1-806-331-3330

List of loan companies in Amarillo (money lenders near You) with addresses and telephone numbers:

| № | Company name | Address | Phone number |

|---|---|---|---|

| 1. | Texas Car Title & Payday Loan Services, Inc. | 9801 South FM 1541, 79118 | +1 806-553-1772 |

| 2. | ACE Cash Express | 5811 S Western St, 79110 | +1 806-355-7665 |

| 3. | Cash Store | 7200 SW 45th Ave Unit 12, 79109 | +1 806-356-7322 |

| 4. | EZMONEY Loan Services | 4210 SW 45th Ave, 79109 | +1 806-354-9102 |

| 5. | Fast Cash Now | 4109 S Western St, 79109 | +1 806-353-7661 |

| 6. | Advance America | 3415 Bell St r, 79109 | +1 806-353-3602 |

| 7. | Check `n Go | 4123 SW 34th Ave #A, 79109 | +1 806-331-2040 |

| 8. | Western Finance | 3101 S Western St #6, 79109 | +1 806-358-0505 |

| 9. | Capitol Loans | 2511 Paramount Blvd, 79109 | +1 806-353-1489 |

| 10. | Dash For Cash | 3409 Georgia St S, 79109 | +1 806-352-3188 |

| 11. | Amarillo Community Federal Credit Union | 6100 I-40, 79106 | +1 806-358-7561 |

| 12. | World Finance Corporation | 1900 E 34th Ave #1600, 79118 | +1 806-371-8900 |

| 13. | TitleMax Title Loans | 3514 Interstate 40 Access Rd, 79103 | +1 806-576-3760 |

| 14. | Network Finance | 203 SW 8th Ave, 79101 | +1 806-372-5626 |

| 15. | Steed Finance Co | 1310 SW 8th Ave, 79101 | +1 806-376-8690 |

| 16. | Fast Cash Time | 719 S Georgia St, 79106 | +1 806-373-8699 |

| 17. | Payment 1 Financial | 1110 E Amarillo Blvd, 79107 | +1 806-367-9744 |

| 18. | ACE Cash Express | 1500 E Amarillo Blvd, 79107 | +1 806-331-0867 |

| 19. | Check `n Go | 1606 E Amarillo Blvd, 79107 | +1 806-331-2050 |

| 20. | Sun Loan Company | 819 Martin Rd, 79107 | +1 806-373-8020 |

| =>> Find more loan companies for fast cash near you or online at #1Payday.Loans | |||

You can also visit the loan store in another city (next to you)!

| № | City / State | Postal code | Distance | Company Title | Reviews |

|---|---|---|---|---|---|

| 1. | Lubbock / TX | 79416 | 126,7 miles | "Advance America" | - |

| 2. | Wichita Falls / TX | 76308 | 228,3 miles | "CashMax Title & Loan" | - |

| 3. | Midland / TX | 79701 | 240,5 miles | "Sun Loan Company" | - |

| 4. | Odessa / TX | 79761 | 257,7 miles | "Sun Loan Company" | - |

| 5. | Abilene / TX | 79606 | 285,9 miles | "Cash Store" | - |

Useful financial advice ...

"Microfinance/Microcredit Business": How to Get Started

Microfinance institutions have been and always will be a financial option especially for lower socioeconomic class. The institutions are often deemed the banks for the poor for a reason: they help lower income families with savings, credit and insurance options.

If you are interested in opening a business in the massive financial industry, opening your own microfinance organization can be a very viable option. Not only it can provide you with a decent earning and sustainability, but you can also meet and help many people along the way.

As long as you have your priorities straight, opening a microfinance institution won't be a hard task. Here are some of the tips that might help you begin:

1. Decide on an Operational Model

Would you be solely focusing on giving microlending? Or will you also be selling insurance options? Deciding on an operational model will also help you with the financing plan.

If you are microlending, decide to focus on one market first. For example, you can focus on giving loans to small business owners, educational needs, or only focusing on business expansion. Focusing on a niche can help increase your reputation in the said market, getting you more clients in the process.

2. Startup Investment

Opening a financial business can require a lot of money, as your liquidity will also determine your profit and earning potential. Being able to lend $100,000 will net you more profits and earning compared to only being able to lend $5,000.

Other investments you may consider is to rent a space. Renting a space can increase your credibility as well as marketability, but can be costly depending on the location. You might then also invest in the necessary office equipment and tools. You can safely start with $50,000 and above.

3. License and Permit

In most locations, setting up a business in the financial industry is heavily regulated. You might need to have several licenses or permit and a liability insurance before you can engage in the business.

Typically your local financial authorities will examine your liquidity as well as several other factors. Consult your local authorities to get a better information for the legal requirements.

4. Setting up a System

You will need to setup a system to do a financial background check for your customers and some ways to collect debts.

Lending money, after all, will always be a risky business, and you'll need to set up a system to secure your liquidity. If you are lending unsecured loans, you will need to think up a process to increase the safety for your business.

Earning Potential

Annual rates for microcredit loans can be higher than 20% annually, meaning if you are lending $100,000 a year in total, you can roughly get a $20,000 profits.

Marketing your business and building a reputation will be the keys to success in this business.

Do You have any positive or negative work experience with this (or other) Financial institution?

Write us a review please! We will submit it on our website. Thank You!