Payday Loans in Florida (locations near Me):

Cash Advance even with BAD credit (instant decision)

Same Day Services - No faxing, No hidden fees, 24/7 online approval!

24BIZ.biz - Assistance in obtaining short-term loans during the day with favorable conditions for you!

"FLORIDA, USA"

| Founded - 1845 (3 Mar) |

|

Capital - Tallahassee

|

Largest city - Jacksonville

|

Population - 20,271,342

|

Area - 65,755 square miles

|

Number of cities - 522

|

Abbreviation - "FL"

|

|

In terms of GDP, Florida is the fourth economy in the United States. The main branches of the state's economy - tourism, agriculture, industry and mining. Every year more than 60 million tourists visit Florida!

What are the advantages of getting a payda loan online?

- Online 24 hours / 7 days

- Fast Approval (about 5 minutes)

- Only Direct lenders (cheap loans)

- Bad credit OK (or no credit history)

- Quick money deposit (same day decision)

- Easy application form (about 2 min)

- NO teletrack / Faxless cash advance

- Up to $1000-$2500 (even with small income)

- Low requirements (18+ y.o., US resident, income)

- We cover ALL cities of the USA, where payday loans are legit

>> Apply NOW (2-min Form)! <<

Do you offer loans with low interest rates?

We work with hundreds of loan companies simultaneously. What does it mean?

Your application will be received by

300 direct lenders, for approval.

Due to the high competitiveness of creditors, we can obtain for you the favorable conditions!

Where can I get fast cash advance with bad credit in Florida (FL)?

If for some reason you do not want to take a loan online, you can visit local off-line credit store. We have selected a reliable companies based on the reviews of ordinary people and our opinion! To find lender's address and telephone, choose Your city below please.

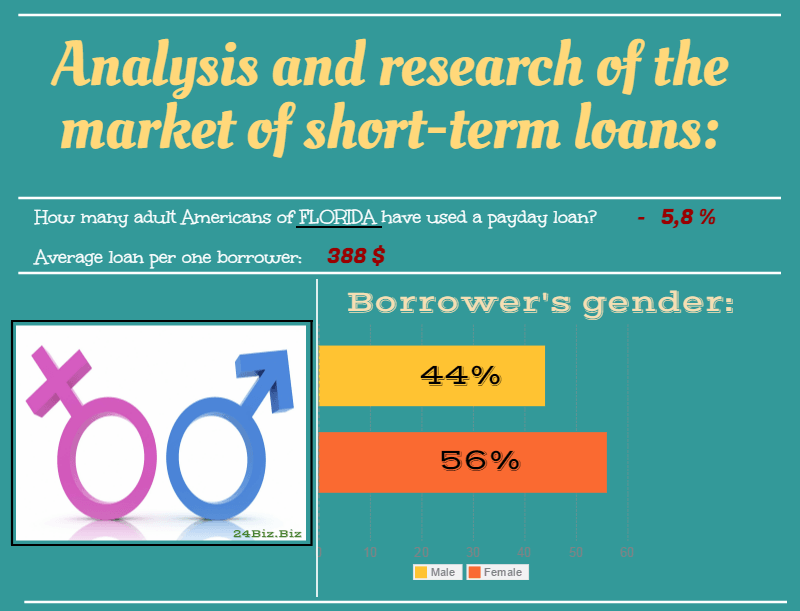

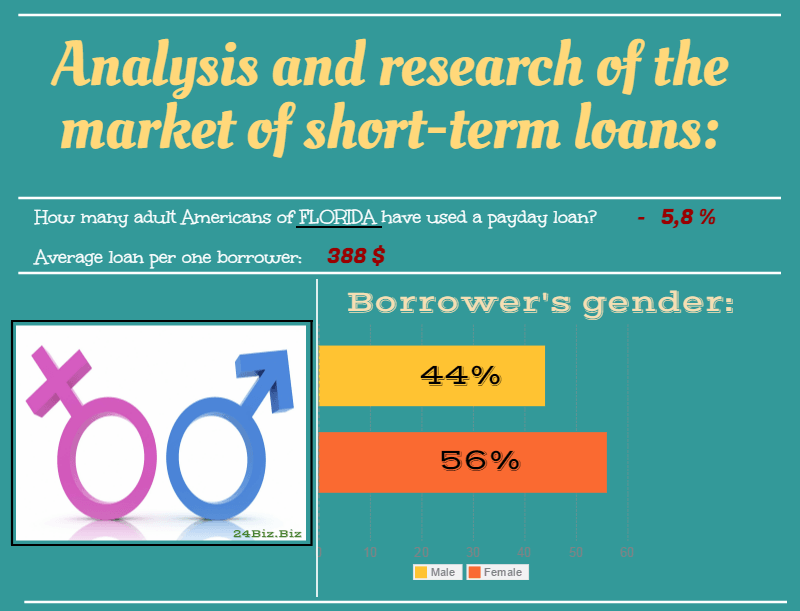

Analysis and research of the market of short-term loans in Florida:

(*based on statistical data of 2015-2016 of company "24Biz")

| How many adult Americans of Florida have used a payday loan? |

5,8% |

| Average loan per one borrower: |

388 $ |

| Borrower's gender: |

| Male |

44% |

| Female |

56% |

| What is the age of borrowers? |

| 18-24 |

14% |

| 25-29 |

17% |

| 30-34 |

8% |

| 35-39 |

13% |

| 40-44 |

13% |

| 45-49 |

15% |

| 50-54 |

7% |

| 55-59 |

3% |

| 60-64 |

3% |

| 65-69 |

5% |

| 70+ |

2% |

| What household income have borrowers? |

| Under $15,000 |

26% |

| $15,000 - $25,000 |

24% |

| $25,000 - $30,000 |

12% |

| $30,000 - $40,000 |

14% |

| $40,000 - $50,000 |

8% |

| $50,000 - $75,000 |

10% |

| $75,000 - $100,000 |

5% |

| $100,000 and Higher |

1% |

| Renters or Homeowners? |

| Renters |

51% |

| Homeowners |

49% |

| Which is a employment status of borrowers? |

| Full-time |

40% |

| Part-time |

22% |

| Unemployed |

16% |

| Homemaker |

5% |

| Disabled |

2% |

| Student |

10% |

| Retired |

5% |

| Education status of borrowers: |

| Some High School |

15% |

| High School |

33% |

| Some College |

40% |

| College |

12% |

| Race & Ethnicity: |

| "White" |

52% |

| Other races |

48% |

| Marital status of borrowers: |

| Single |

29% |

| Married |

30% |

| Divorced |

21% |

| Widowed |

5% |

| "Civil marriage" |

15% |